Revolutionizing Digital Transformation in Banking with API Gateway Technology

Explore the transformative role of API Gateway technology in digital banking. Learn how it empowers financial institutions with agility, security, and seamless integration for a future-ready banking ecosystem

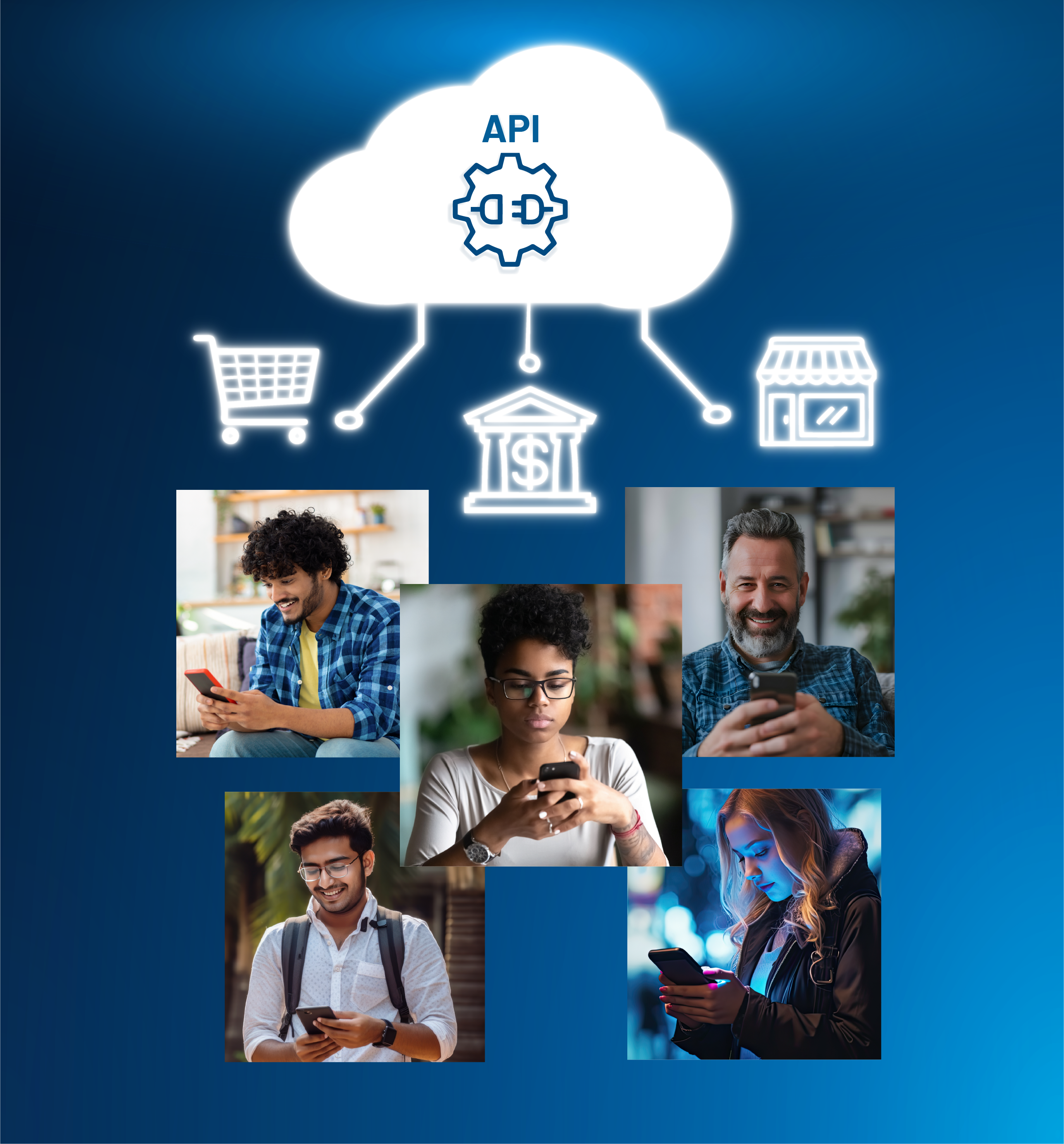

In an era where digital transformation is not just an advantage but a necessity, the financial sector stands at the forefront of innovation. The rapid evolution of digital banking demands solutions that are not only robust and secure but also flexible enough to adapt to changing market dynamics. This is where the power of API Gateway technology becomes undeniable, acting as the cornerstone for modern digital banking ecosystems.

The Role of API Gateways in Digital Banking

API Gateways are crucial conduits facilitating seamless communication between disparate banking systems, applications, and services. Imagine a bustling city where every inhabitant speaks a different language, yet everyone can effortlessly interact, trade, and collaborate thanks to a universal translation system. Similarly, API Gateways ensure that various components of the digital banking landscape work harmoniously, enabling financial institutions to deliver frictionless and secure customer experience.

Advantages of API Gateway Adoption

Strategic Agility: API Gateways allow banks to swiftly deploy new services and adapt to market shifts, ensuring they stay ahead in the competitive landscape.

Security and Efficiency: They offer a centralized hub for managing data exchanges, bolstering security protocols while streamlining operations and enhancing customer relations.

Integration and Versatility: The ease of integrating with various technologies reduces the complexity of digital services, allowing banks to focus on innovation and core objectives.

Euronet’s Ren API Gateway emerges as a pivotal solution, perfectly aligned with what modern financial institutions require to thrive.

How Euronet’s Ren API Gateway Powers Digital Banking

Digital Banking’s Backbone: The Ren API Gateway simplifies the intricate web of digital banking, providing a platform for effortless and secure interactions across the financial ecosystem.

Accelerated Financial Services: Ren offers the agility needed to deploy new services rapidly, empowering institutions to respond quickly to new opportunities.

Navigating Financial Complexities with Ease: Ren guarantees secure and efficient data flow, ensuring compliance and enhancing customer trust in an increasingly digital world.

Future-Proof Your Financial Ecosystem: With the Ren API Gateway, banks are equipped to meet today’s demands while being adaptable to future developments in digital payments.

A Partnership for the Future

The shift towards digital banking is irrevocable, and the adoption of API Gateway technology is a testament to an institution’s commitment to innovation and customer satisfaction. Euronet’s Ren API Gateway is more than just a product; it’s a strategic ally in the journey toward digital transformation, designed to meet the nuanced demands of the financial sector.

Engage with Euronet’s Ren API Gateway

Discover the transformative potential of the Ren API Gateway for your institution. Embrace the technology that powers seamless, secure, and efficient digital banking.

To explore how Euronet can support your digital transformation journey, contact our team or visit us at https://euronetsoftware.com/.

Meet Our Expert: Randall Hula

Randall Hula is a Global Product Marketer at Euronet Software Solutions, where he collaborates with senior management to deploy targeted communications strategies across the company’s global operations. With a rich background in consumer insights and strategic communications across diverse industries, including consumer packaged goods, healthcare, and retail, Randall brings fresh and influential ideas to the financial services and payments industry.

Exploring Innovations in Global Financial Technology

Incremental Innovation

How Euronet's Ren Payments Drives Digital Innovation The banking sector stands at a pivotal moment, caught between its legacy systemsand the pressing need for digital transformation. As customer expectations soar andtechnological advancements continue to disrupt the...

Modernizing Mozamibique

In an era where digital innovation often drives market leadership, our latest white paper reveals the power of Euronet's Ren technology in transforming Mozambique's banking sector. Discover how you can leverage this technology to not just keep pace, but lead in...

Balancing ATM Features and ROI

Many financial institutions are looking to shift a number of transactions that were previously performed by tellers to self-service ATMs and kiosks as they strive to find ways to increase customer engagement while reducing costs. Advancements in technology now make...