Blogs

Contact UsBalancing ATM Features and ROI

Many financial institutions are looking to shift a number of transactions that were previously performed by tellers to self-service ATMs and kiosks as they strive to find ways to increase customer engagement while reducing costs. Advancements in technology now make...

Time to Cash In: Why Cash Recycling Makes (Dollars and) Sense for Today’s ATMs

With all the talk about the “death of cash” it may surprise you to learn that more account holders use the ATM than any other banking channel.1 In fact, according to a study by J.D. Power, over half of consumers used an ATM or drive-thru to get cash in 2020.2 While...

The Case for Interactive Teller Machines

Interactive Teller Machines (ITMs) are gaining popularity in the United States, and many banks are considering adopting these highly functional devices. ITMs go beyond cash withdrawals, check and cash deposits, account transfers, and bill payments, offering services...

Real Time Payments: The Railroad of the Banking World

With a rise in real-time payments (RTP) worldwide, banks and solution providers are rushing to fill out their offerings of digital overlay services. Digital overlay services are value-added services that utilize the rails of an RTP network to enable and showcase the value of a real-time transaction. We’ve seen this before, back in the 19th […]

How the Pandemic Accelerated Digital Payments in Asia

In SE Asia, cash is still the predominant form of payment. Being from the U.S. and going from paying for my coffee with cards or my smartphone to paying with cash required a mindset change. But that’s where I found myself as the pandemic exploded last year. I wanted to use my card and phone […]

The ATM Re-Imagined

More than a year has passed since the COVID-19 pandemic became part of our lives, and our “new normal” started taking shape. Changes in our social behavior led to changes in the ways we do business. We increasingly avoided physical retail stores, opted for online shopping, and converted to digital forms of payment. Consequently, the […]

Connect to Faster Payments While Minimizing Risk

More than ever, your customers demand fast, convenient, and digital payments. Far beyond pizza delivery, consumers ordered everything from exercise equipment to cat litter to theatre tickets online – delivered straight to your door or email inbox. Classes from kindergarten through University are streamed live. Food delivery services, groceries ordered online and picked up in […]

Our ATMs Deliver Something More Valuable than Cash

In a recent press release, Euronet Worldwide, a global financial technology solutions and payments provider, announced that the placement of AMBER Alerts on its ATM screens in several European countries had resulted in hundreds of phone calls and the successful location of eight missing persons during 2020. AMBER Alerts are emergency messages issued when a […]

“None of us is as smart as all of us”

Renowned business author Ken Blanchard noted the importance of collaboration in “The One Minute Manager.” That quote speaks volumes for banks interested in joining a real-time payment network. As the trend of real-time payments has swept over the world, it has repeatedly shown success, and with success comes another surge in participation. Everyone from banks […]

Innovating While Lowering Costs in a New Payments World

As we start reopening of the economy, what might the world look like for the payments industry? In this link, Accenture shares 10 ways COVID-19 is impacting payments (May 5, 2020). It’s likely that the first two impacts mentioned – that the largest economies will stumble hardest, and that consumer spending will be in retreat […]

Keeping Cash Flowing Amid a Worldwide Pandemic

As more and more nations are feeling the effects of the COVID-19 virus, virtually every aspect of our lives have been impacted in one way or another. To decrease the speed at which the virus spreads, social distancing, curfews, and in some areas commercial business shutdowns of all but essential services have become the norm. […]

Are You Prepared for the Contactless Payments Surge?

Consumer adoption of contactless payments via cards, wearables, and mobile wallets, has been increasing at a consistent pace. Not huge leaps forward, but consistent growth. Solutions like those for the London Underground has helped propelled consumer usage. Still, certain regions of the world are trailing in the adoption of contactless. Will the novel coronavirus serve […]

Enabling Instant Payments Doesn’t Happen in an Instant

The adoption of instant payments, nearly doubling over each of the past five years, has motivated countries to implement their own Instant Payment networks. These national networks seek to create a streamlined and regulated channel by which instant payments can thrive in a controlled and trackable environment. Some of the earliest adopters include TIPS in […]

Incremental Innovation – Evolving in a Changing Payments Landscape

Incremental Innovation – Evolving in a Changing Payments Landscape Rapidly Changing Payments Landscape Payments are experiencing many evolving trends which are disrupting and reshaping the payments landscape. The highly competitive financial industry is faced with a level of constant change which has forced organizations to adapt at a pace which has never been seen in […]

Open Banking – Empower Consumers Through Innovation

Open Banking – Empower Consumers Through Innovation The Open Banking Revolution Open banking, the ability of third-party applications to access consumer banking and financial accounts using Application Programming Interfaces (API), is becoming a major source of innovation and is poised to reshape the competitive landscape of the banking industry. By networking accounts and data across […]

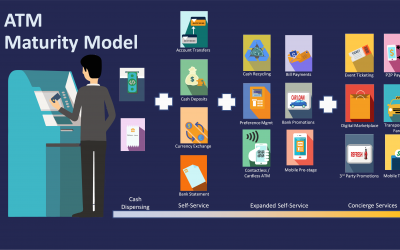

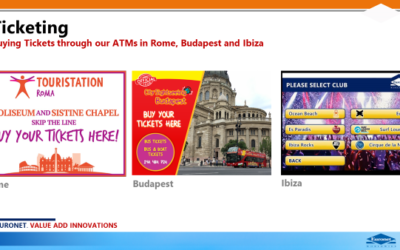

ATMs and the Next Generation

ATMs, initially designed to dispense cash, have greatly expanded services over time. Cash and check deposits, transfers, ordering of checks or statements, and FX currency dispensing all connected the customer to an increasing number of banking products and services. Connection to a larger payments ecosystem followed with the introduction of utility bill payments, remittance, charity […]

Trends that will shape the Payments Industry in 2020

In reviewing industry expert’s assessment of 2020 trends, we see similar themes emerge: the rise of contactless payments and the decline of cash payments; cross-border payments increasing, while payment saturation rises; fraud protection. The last few years – 2019 in particular – have witnessed a meteoric rise of fintechs. All of this, perhaps, guided by […]