Many financial institutions are looking to shift a number of transactions that were previously performed by tellers to self-service ATMs and kiosks as they strive to find ways to increase customer engagement while reducing costs.

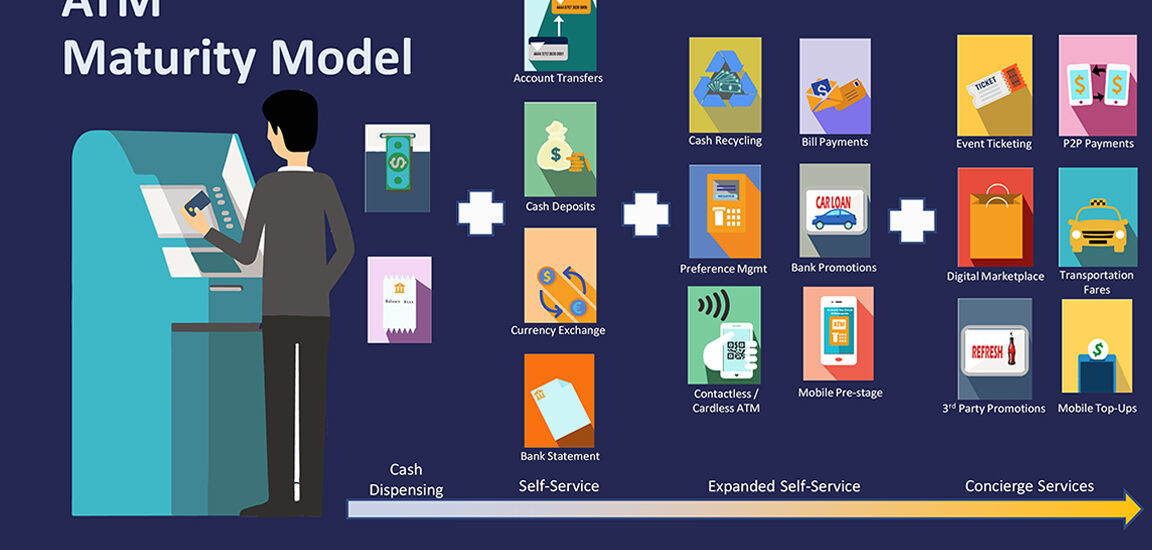

Advancements in technology now make it possible for today’s modern ATMs to handle a wide variety of transactions as well as offer a wide variety of functions such as cardless, cash recycling, digital wallet pay-outs, and even third-party product promotions.

While it might be “nice” to implement every feature and function at each ATM location, there is a cost associated with this that must be assessed and weighed. Generally, the more features and functions that are enabled, the greater the hardware and software licensing costs.

How do you determine the right mix of features and services for your user base? Like any good plan, the answer is found through research and analytics. The best analytics in this case come from real- time monitoring of your current ATM fleet.

To take full advantage of the insights gleaned from analyzing the real-time data from your fleet, you need a fleet management system that not only allows you to capture the data, but that allows you to quickly make and send updates to your fleet with drag & drop screen changes and remote commanding. And of course, a system that supports in-demand features like contactless, P2P, bill payments and even targeted offers at the ATM.

When managed properly and designed for optimized customer experiences, ATMs have enormous potential and the capability to provide personalized, timely and engaging interactions. Euronet’s Ren Self-Service provides the comprehensive tools organization’s need for real-time ATM fleet monitoring and efficient remote management.