ATMs, initially designed to dispense cash, have greatly expanded services over time. Cash and check deposits, transfers, ordering of checks or statements, and FX currency dispensing all connected the customer to an increasing number of banking products and services.

Connection to a larger payments ecosystem followed with the introduction of utility bill payments, remittance, charity donations, prepaid airtime and digital wallet top-up.

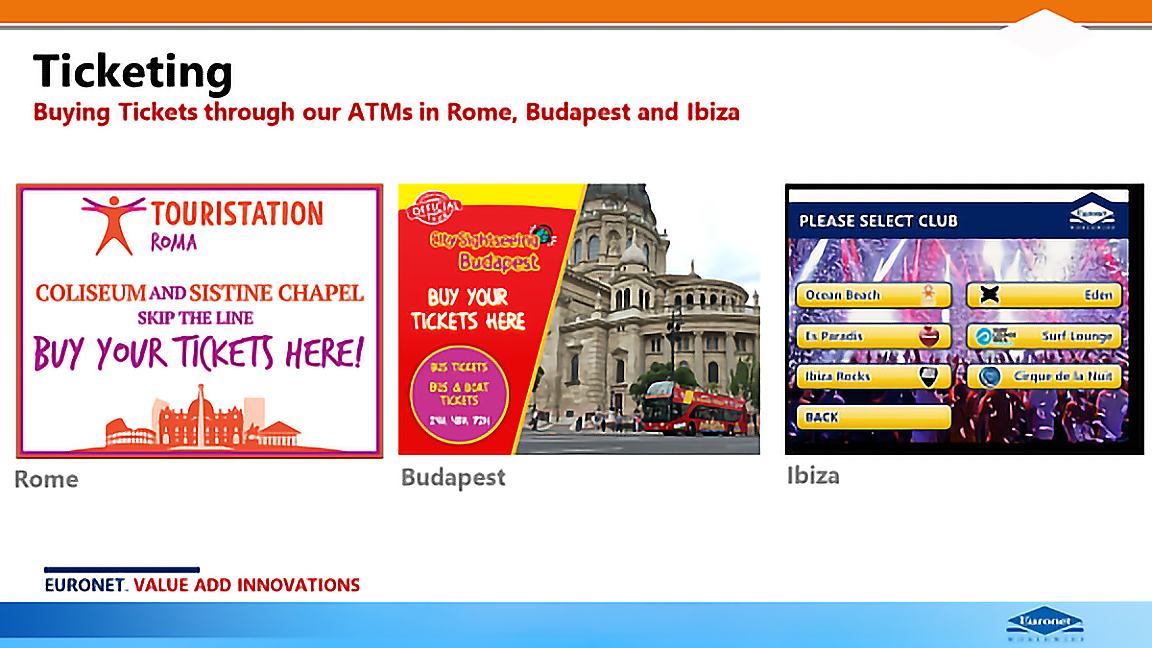

Today, the ATM is a marketplace for a host of non-traditional banking services, enabling the user to purchase digital content, lottery, event and museum tickets, as well as transportation passes. At the same time, ATM screens have found their place in the world of advertising, displaying generic or personalized – often interactive – targeted messages to users.

These enhanced services attract new consumer market segments of digitally savvy individuals who view the ATM as a one stop shop, fulfilling multiple payment needs, banking or retail, at home or when traveling.

Globally, Gen Z users come to expect these ATM transactions. They receive or transfer money, buy digital content, pay bills, buy airtime, and travel the world. When transacting, they appreciate the practicality and speed of diverse digital channels. Innovative ATMs fit well with the Gen Z profile as a fast and reliable hub to a variety of everyday activities or special experiences. The ATM underlying technology is also rapidly evolving, transitioning from cards to mobile phones and from PIN security to biometrics, in line with Gen Z preferences.

Financial institutions and ATM operators who embrace diverse transaction capabilities and cutting-edge technology on their terminals will succeed in attracting the next generation to the ATM and enhance their presence and brand identity in the payments landscape of tomorrow.